Is your business struggling to break even? Do you only make a profit every once in a while? Are you desperately trying to figure out how to make more money? If your business is only making minimal profits or no profits at all, the profit first method can help. This procedure will completely change the way you think about making money at your business and will help to turn it into a cash cow in no time!

Profit First is a way of looking at the traditional profit statement in a new light. Generally, when most people run a business, they take their sales, subtract their expenses, and are left with a profit. The Profit First ideology encourages a modification. With this philosophy, you would take your sales, subtract the profit, and then you are left with expenses.

When businesses take out their profit first, it forces them to be more resourceful and innovative to earn enough to cover expenses. With this model, profit is not an afterthought that you hope for; instead, it is a priority that you plan for. With Profit First you will take out your profit before you do anything else, adjust your operations to reflect your true operating expenses, and start building up cash reserves and eliminating your business financial stress.

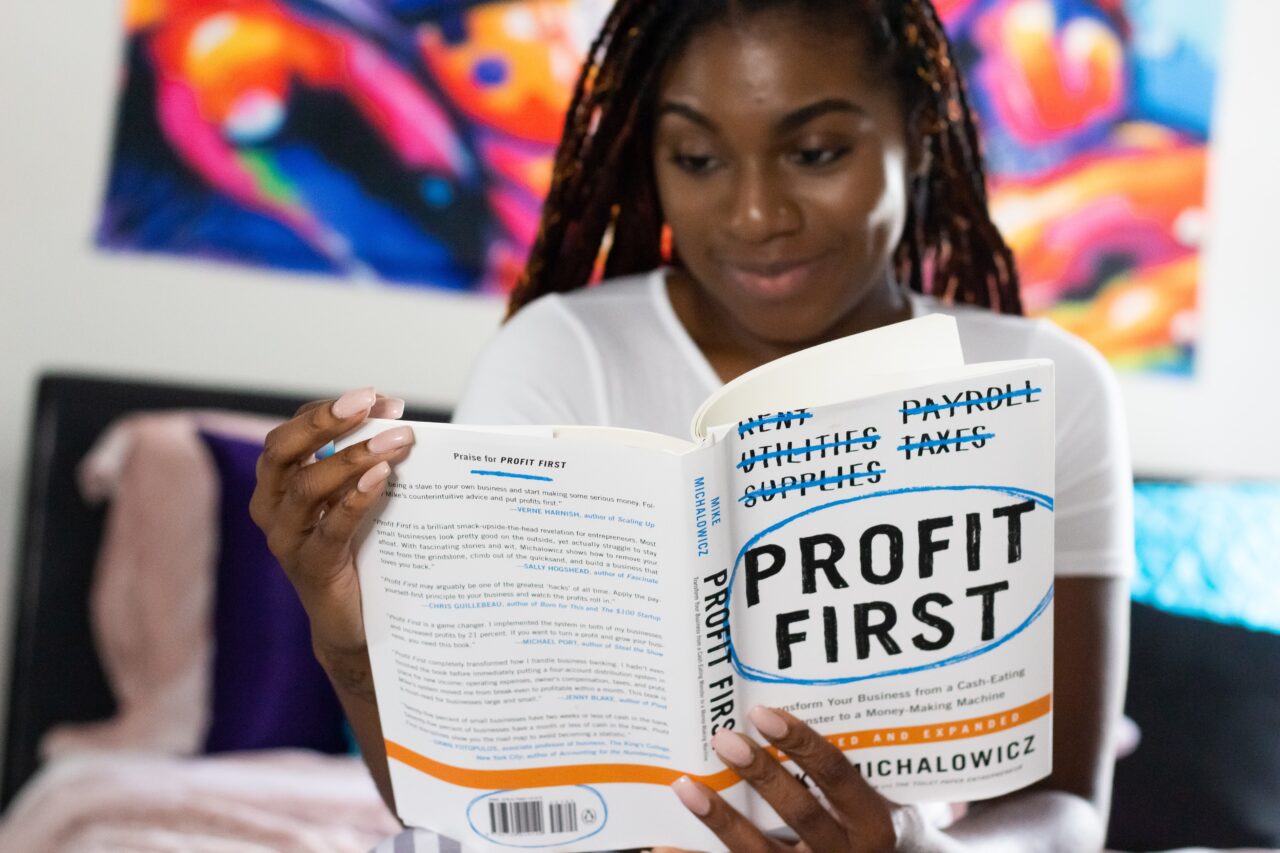

This model was devised by Mike Michalowicz. He spelled out the entire process in a book called Profit First: Transform Your Business from a Cash-Eating Monster to a Money-Making Machine. Since its publication, over 175,000 companies have implemented the system.

Profit First effectively uses the concept of “out of sight, out of mind”. If you take out profit immediately and put it off to the side where you cannot “see it”, then you will be less tempted to spend it. This system is designed to give you clarity about how you spend money on your business and discover how you can streamline processes so that you can increase your profits as much as possible.

It truly is a simple system that does not require an experienced accountant to implement. You can get started at any time and do not have to worry about doing anything retroactively.

Let's discuss a quick overview of how to set up a profit first system and implement profit mechanics.

Before you can start using this system, you will need to set up a few different bank accounts.

Income — This account is where all of your income will be deposited initially before moving into one of the other accounts.

Profit — This account will house the percentage of profit that you are setting aside.

Owner's Compensation — Do not forget to pay yourself! This oversight is one of the biggest pitfalls of small businesses.

Tax — Creating an account specifically to pay business taxes will ensure that you always have enough.

Operating Expenses — Any money left over will go into this bucket to cover your operating expenses.

In addition to these five main accounts you should also set up two more accounts at a separate bank where you can keep money out of sight and not be tempted to dip into it. The first is your Profit Hold account that will house your profit allocations until you distribute them at the end of each quarter. The second is your Tax Hold account where you keep money that will go toward taxes until it is time to pay them.

First you will need to understand how you are currently allocating your money. Once you know what your current percentages are, compare them to those of a healthy business that is similar to yours. Make sure that your comparison business operates at a comparable revenue level.

You need to make sure that the changes you make are gradual. If you currently only have a 5% profit then you cannot suddenly declare that you will have 60% profit. Setting realistic goals for your company in one of the most important steps on the journey toward achieving them.

Twice a month, allocate the funds from your umbrella account, the income account, into your five main accounts. While you may be wondering if it is okay to allocate funds daily or as needed, the recommendation is twice a month so that you establish a healthy rhythm that is not overwhelming. This schedule will also allow you to keep excellent track of your healthcare trends.

You should start by using your current percentages and then slowly up your profit percentage until it matches that of your comparison company. Make sure to move the profit and tax amounts into their hold accounts so that you will leave that money alone.

At the end of the quarter, half of the amount in the profit hold account can go to the owner as a reward while the second half should go toward building capital reserves for the company. You should also consider paying down debt with this money.

The Profit First method certainly is not for everyone. Some people have a hard time implementing it and sticking with it. Here are a few common pitfalls that people experience and some tips to avoid them.

Sometimes newbies get their initial allocation percentages incorrect. When that happens they start from the wrong place and do not grow as they should. Make sure that you are very careful when making your calculations so that you do not miss anything.

Occasionally, people have issues managing everyday expenses in conjunction with less frequent large purchases and run out of cash. There are a few ways to deal with this including timing your allocations properly and creating a separate account for emergency expenditures.

Some people go into overdrive trying to cut every expense imaginable. While cutting expenses is critical, you cannot let this emphasis on expense control get in the way of offering a quality product or service. Consider negotiating with suppliers for the best possible deals for great products instead of substituting for a lower quality.

Some business owners struggle to really adopt the principles of Profit First. They fall into bad habits like stealing money from the wrong account or racking up credit card debt and quickly lose hope in the process. When trying something new, it can be easy to be excited about it at first but often that excitement quickly fades when things start to get challenging. Try to keep the faith and realise that Profit First is a process that will not change everything overnight.

Some people may be more likely to run into problems with Profit First than others. If you find yourself in one of these categories then you may be more suited for another type of profit management system for your business.

People who struggle following through with new habits may struggle to adapt to the Profit First method. This process requires discipline that can be extremely challenging for some business owners to attain. On the flip side, people who are overly ambitious may be too aggressive in adopting the system and burn out. You need to make sure that you use the process sustainably so that you do not run out of cash to cover your operating expenses.

If you are running a startup that is funded by venture capitalists who expect to see aggressive growth, you may experience pushback trying to implement Profit First. This system is built for more gradual and sustained development over time. If your funders want aggressive growth as quickly as possible, you will have a hard time delivering with this system because that is not what it is meant to do.

If your accounting team is sceptical and will not get on board, then you may need to try something else. Profit First requires complete buy-in and is not worth doing if you are only going to be able to do it halfway.

If your bank wants to charge exorbitant fees on every new account you open, then this method with several bank accounts might not be the best way to go. However, you could always switch banks or try to negotiate for better deals, especially if you have been a loyal customer for an extended period. If you do decide to switch, you may want to explore credit unions because they tend to have fewer fees.

Profit First is a set of profit mechanics that can help you take your business from struggling to stay afloat to an undeniable success if you are willing to stick with it. You do not need to have any advanced experience in accounting to get started, so you could get going as soon as today! There is no better time than the present to transform your business and rid yourself of stress.